- Wild Newsletter

- Posts

- Your Brain Is Trying to Screw Your Investments

Your Brain Is Trying to Screw Your Investments

How to spot the emotional traps before they cost you big time

This newsletter is brought to you by:

Discover How to:

Build 7-Figure Wealth Through Long-Term Investing

Here is what to expect:

✔️ World-Class Investment Program

✔️ Weekly Optional Group Q&A Sessions

✔️ Top Long-Term Investment Resources and Tools

✔️ Elite Community of Entrepreneurs and Professionals

✔️ Networking, Events, Deals, Opportunities and Bonuses

✔️ Financial Markets, Asset Classes, Portfolio Management, Execution

If this resonates, you are a great fit for our:

Investment MBA

An online community-powered program I am launching soon.

Submit your application here:

Hey,

I had lunch with my investor friend this week:

We ended up talking about the biggest enemy in investing - our emotions.

Let’s get real. Investing isn’t just about numbers and charts.

It’s about human behavior - and that’s where most of us slip up.

Behavioral biases mess with your head.

They twist how you see things, how you decide, and how you act:

Often without you even realizing it.

Remember how many sold in panic during the financial crisis or the COVID crash?

We all know now those moves weren’t smart but back then, emotions took over.

Understanding these biases isn’t just smart, it’s essential.

It helps you see your own blind spots and gives you the power to make clearer, calmer decisions.

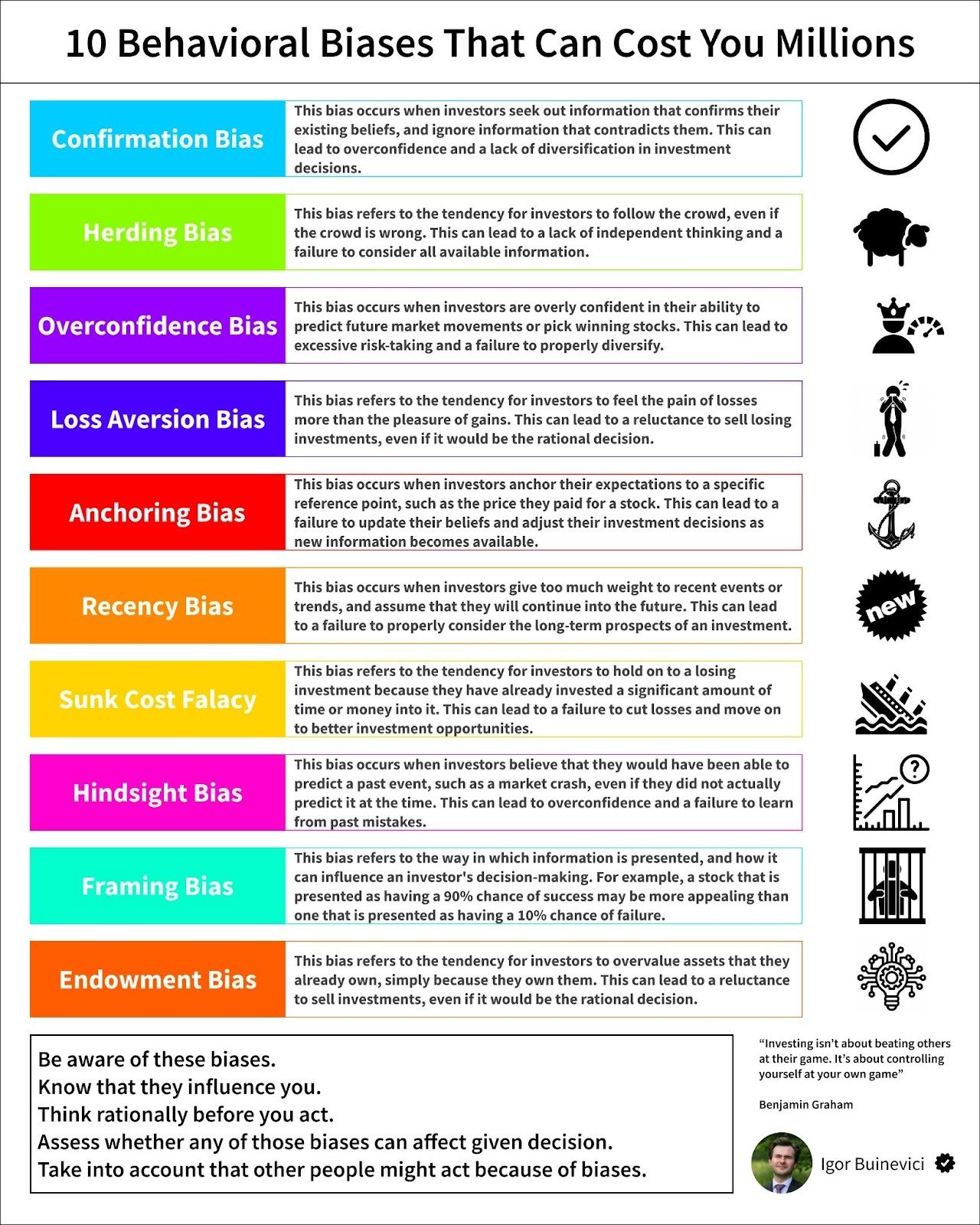

Here are the Top 10 Behavioral Biases wrecking investors worldwide:

1) Confirmation Bias

You only hear what you want to hear.

You chase info that confirms your beliefs - ignoring warnings and red flags.

Result? You stay blind to real risk.

2) Herding Bias

Everyone’s buying, so you buy too.

No independent thinking, just FOMO.

The crowd doesn’t know best - it often leads to bubbles.

Or when crisis hits, you want to sell when markets go down.

Don’t hurry and analyse the situation properly.

3) Overconfidence Bias

You think you’re smarter than the market.

You bet big, trade often, and ignore the facts.

The market humbles overconfidence every time.

4) Loss Aversion Bias

Losing hurts more than winning feels good.

So you hold losing positions hoping they’ll bounce back and miss better opportunities elsewhere.

5) Anchoring Bias

You get stuck on the price you paid or some old info - ignoring what’s really happening now.

That anchor drags your decisions down.

6) Recency Bias

Recent wins make you feel invincible.

Recent losses terrify you.

You forget that markets swing, and past short-term moves don’t predict the future.

7) Sunk Cost Fallacy

You continue to throw away money (or time) after bad trade, just because you’ve already invested a lot.

Sometimes the smartest move is cutting losses and moving on.

8) Hindsight Bias

After a win or crash, you convince yourself it was obvious all along.

Spoiler: It rarely is. Overestimating your foresight is dangerous pride.

9) Framing Bias

How info is presented changes how you react.

“90% success” sounds good, “10% failure” feels scary - but it’s the same fact.

Don’t fall for the spin.

10) Endowment Bias

You overvalue what you own.

That favorite stock or asset suddenly seems priceless - making it hard to sell when logic says you should.

I prepared a special infographic for you, which offers a comprehensive summary of each bias:

Your brain is wired to trick you.

Emotions, instincts, biases - they all push you away from smart investing.

The fix? Awareness and discipline.

Know these traps exist. Build rules to fight them.

Always pause before you act on gut feelings.

This is only one of many interesting topics I will cover in the investment MBA.

Applications for the program are now live.

You will learn how to build 7-figure wealth through investing.

1,000+ people are on the waitlist. And we take only 5 people in.

You will work directly with me + get plenty exclusive bonuses.

Check all the info and apply here: mba.wildcapital.co

To clear heads and sharp decisions,

Igor